Offshore Company Formation: Structure Your Service Past Borders

Offshore Company Formation: Structure Your Service Past Borders

Blog Article

Approaches for Cost-Effective Offshore Business Development

When taking into consideration overseas company development, the pursuit for cost-effectiveness comes to be a vital concern for companies seeking to expand their procedures internationally. offshore company formation. By checking out nuanced methods that blend lawful compliance, financial optimization, and technical innovations, services can get started on a course towards offshore business formation that is both financially sensible and strategically sound.

Choosing the Right Territory

When establishing an offshore company, selecting the appropriate jurisdiction is an essential choice that can substantially affect the success and cost-effectiveness of the formation process. The territory selected will determine the regulative framework within which the firm operates, influencing taxes, reporting demands, privacy regulations, and general company flexibility.

When picking a territory for your overseas firm, a number of factors have to be considered to ensure the choice lines up with your critical objectives. One essential aspect is the tax obligation routine of the jurisdiction, as it can have a significant effect on the firm's success. Additionally, the degree of regulatory compliance needed, the political and economic stability of the jurisdiction, and the convenience of doing service should all be assessed.

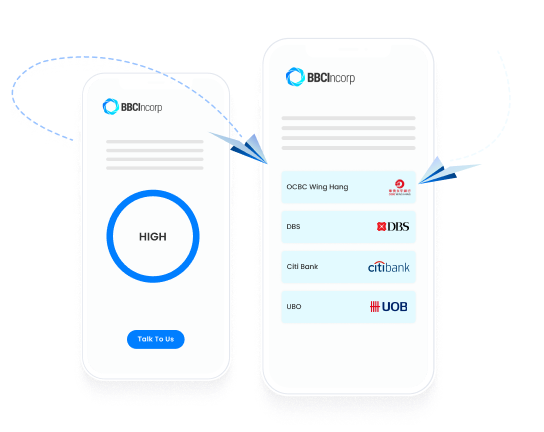

Additionally, the track record of the territory in the international business community is crucial, as it can influence the assumption of your company by clients, companions, and banks - offshore company formation. By very carefully assessing these aspects and looking for specialist advice, you can choose the appropriate jurisdiction for your offshore company that enhances cost-effectiveness and sustains your business goals

Structuring Your Company Successfully

To guarantee optimum performance in structuring your offshore company, careful focus must be given to the organizational framework. By developing a clear possession framework, you can guarantee smooth decision-making procedures and clear lines of authority within the firm.

Next, it is vital to take into consideration the tax obligation ramifications of the chosen structure. Different territories supply varying tax obligation advantages and motivations for overseas firms. By meticulously analyzing the tax obligation legislations and guidelines of the picked territory, you can enhance your business's tax obligation effectiveness and decrease unneeded expenditures.

Additionally, preserving appropriate paperwork and records is critical for the efficient structuring of your overseas firm. By keeping current and exact documents of monetary transactions, corporate choices, and compliance files, you can guarantee openness and liability within the company. This not just promotes smooth procedures however additionally helps in showing conformity with regulative needs.

Leveraging Modern Technology for Cost Savings

Effective structuring of your overseas business not just pivots on careful attention to organizational frameworks but also on leveraging innovation for financial savings. One way to leverage innovation for financial savings in overseas business link development is by utilizing cloud-based services for data storage and collaboration. By incorporating modern technology purposefully right into your overseas company formation procedure, you can achieve substantial financial savings while boosting operational effectiveness.

Minimizing Tax Liabilities

Utilizing strategic tax obligation preparation methods can effectively decrease the financial problem of tax obligation liabilities for overseas companies. One of the most common methods for Full Article decreasing tax liabilities is through earnings changing. By distributing revenues to entities in low-tax jurisdictions, overseas firms can lawfully decrease their general tax commitments. Furthermore, making the most of tax obligation rewards and exemptions supplied by the jurisdiction where the offshore firm is signed up can result in significant savings.

An additional strategy to lessening tax obligations is by structuring the overseas company in a tax-efficient manner - offshore company formation. This includes carefully creating the ownership and functional framework to optimize tax advantages. For instance, establishing a holding firm in a territory with beneficial tax obligation legislations can aid minimize and combine earnings tax direct exposure.

Furthermore, staying upgraded on global tax obligation guidelines and compliance demands is crucial for decreasing tax obligation responsibilities. By ensuring rigorous adherence to tax obligation legislations and laws, offshore companies can stay clear of costly charges and tax conflicts. Looking for specialist guidance from tax specialists or legal professionals concentrated on international tax obligation issues can also give beneficial insights into reliable tax preparation approaches.

Ensuring Conformity and Threat Reduction

Applying durable compliance steps is crucial for overseas business to reduce threats and maintain regulatory adherence. Offshore territories commonly deal with increased scrutiny due to problems relating to money laundering, tax evasion, and other economic criminal activities. To ensure conformity and alleviate dangers, overseas business should conduct complete due diligence why not look here on clients and company partners to avoid participation in illegal activities. In addition, implementing Know Your Consumer (KYC) and Anti-Money Laundering (AML) procedures can aid confirm the legitimacy of deals and guard the business's reputation. Normal audits and evaluations of monetary records are critical to determine any kind of irregularities or non-compliance issues without delay.

In addition, remaining abreast of altering laws and legal demands is crucial for overseas business to adjust their conformity techniques appropriately. Involving lawful specialists or compliance experts can provide important support on navigating complex governing landscapes and ensuring adherence to worldwide requirements. By prioritizing compliance and danger reduction, overseas companies can improve openness, construct trust fund with stakeholders, and safeguard their operations from prospective lawful consequences.

Final Thought

Using strategic tax planning methods can successfully reduce the financial concern of tax liabilities for overseas firms. By dispersing earnings to entities in low-tax territories, offshore business can lawfully reduce their general tax obligation obligations. Furthermore, taking advantage of tax rewards and exemptions offered by the jurisdiction where the overseas firm is signed up can result in considerable cost savings.

By making sure strict adherence to tax laws and guidelines, overseas business can prevent expensive penalties and tax disputes.In conclusion, cost-effective overseas company development calls for cautious consideration of jurisdiction, efficient structuring, modern technology application, tax obligation minimization, and compliance.

Report this page